What if the next 90 days could change your life?

Our 90-day Sprint is Crafted to Dramatically Alter your Financial Future

If we started today- your world could be different by

We are not your Parent's advisor

THAT Advisor waits at the finish line for you to arrive with money to manage.

We are at the starting line with you and enduring this marathon together.

Proactive In-House Management

No need for 3-4+ professionals, paying each their fee, & hoping they agree on a plan of action for you.

No more “this app” for budgeting, “that app” for investing, “another app” for financial planning etc. and tying it all together on a spread sheet or in a notebook.

Tie in with an Expert to help with the whats, whens, whys, hows and regain focus on the things that truly matter to YOU in life.

Personalized Risk Action Plan

No two people have the same needs, limits, wants, and means.

Your plan or strategy shouldn’t either.

• Your risk tolerance is unique to you.

• The capital you invest is a unique amount to you.

• The returns required and date required by are unique to you.

This will help you RELIABLY establish your future goals.

No investment or returns are guaranteed- but more structure leading to more predictability is nearly guaranteed peace of mind.

Concierge Grade Service

Genuine White-glove operation. We help with ANYTHING involving your household cashflow.

Insurance shopping/reviews, goal-based planning, {insert your request here} – we will do it all.

• “Braces would improve my child’s life, how can We afford them?”

• “There has to be a way to get a better interest rate, right?”

• “I want to give my family experiences they will remember & cherish. How can I do that? “

We are DEDICATED to your financial well-being. Let’s get rid of those question marks.

Avg. non-mortgage debt (Millennials)

Have less than $1000 in savings (Millennials)

Have no retirement savings at all (Millennials)

You are at a Pivotal Point in Life

This Good Boy Wants to See You Live Your Best Life

He doesn’t want to see you worry – he wants to feel joy in your spirit when you pet him. A little intentional effort helps to avoid problems/stressors like-

-

This job isn't what I want to do, but we need the money

-

My bills are more each month than what we are bringing in

-

I don't know if I will ever get to retire

-

I keep paying and paying and these debts never seem to go down

-

One day I will do what I want- when I have the time and money

Our Process Covers Every Basis to Assure You are on the Greatest Path to Achievement

Our Risk Triage Method puts into order the greatest financial exposures you face and establishes a defined monetary limit you will account for if they occur. Once we have our defense in place- it’s time to play offense.

-

Address Mortality and Disability Risk

-

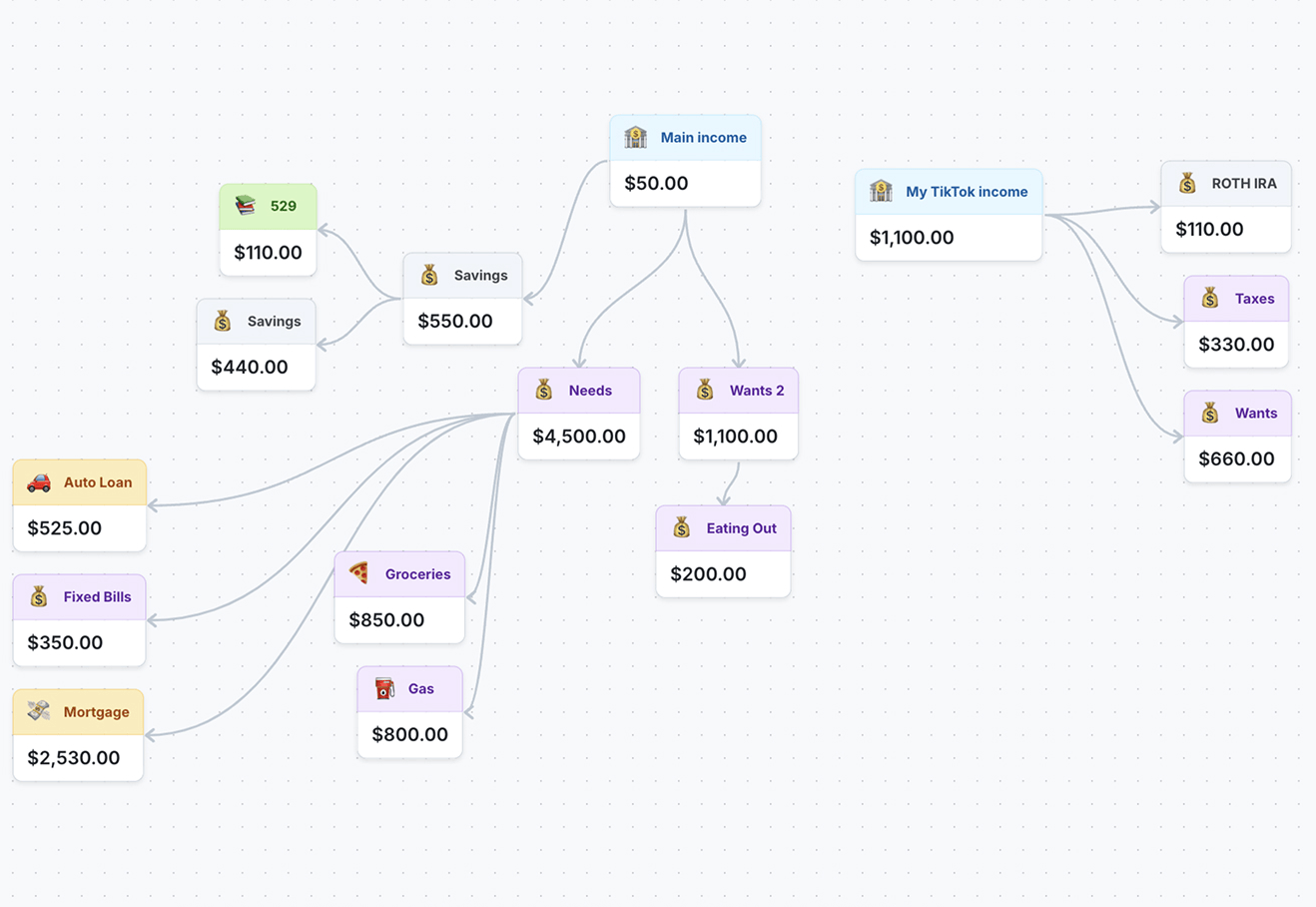

Establish a Budget for a Positive Cashflow Spread

-

Set up Your Financial Scorecard and Risk Tolerance Profile

-

Automate your Cashflow, Reduce Consumer Debt, and Invest to Insulate your Life

-

If We've Done the Rest Right, Money & Time will be Back on Your Side

Become a Flagship Client with $0

We are serious. You do not pay us a penny until the end of your plan period. We told you we are not your Parent's advisor and we meant it. No Management % fees. 1 flat dollar fee at the end of each period.

Plans & Pricing

Everyone is different. You may want it done for you or shown how to do it yourself.

We will meet you where you are at and build this future with you from there.

The Do-it-yourself-er

We Give You the Tools - You Build Your Dream-

Education Corner for Non-Individualized Group Financial Guidance

The Do-it-for-me-er

We Do It All For You-

Insurance Reviews

One-Time Financial Plan

We Give You a Static Blueprint-

1 tb storage

-

Complete Financial Plan

This 8 step financial plan dives into everything surrounding your inflows, outflows, dependents, goals, projections, risks, etc.

It is a blend of where you are at and where you want to be. From there, we establish key action steps to move from point A to point B.

The Do it for me plan is continuously adjusted and reviewed. The One time plan is only completed at the time of service. -

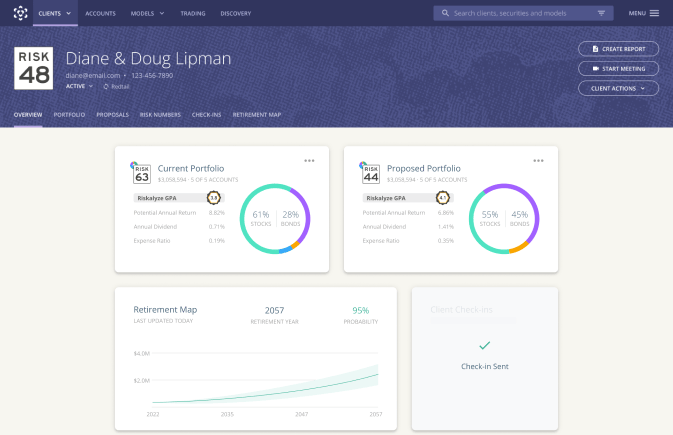

Personalized Risk Assessment

This assessment reviews your investment risk tolerance and the risk exposure of your investment portfolio. It also gives a snapshot of your plan's likelihood of success given any perimeters. You want to buy a house? Have children? Move? Quit your Job? We can project for it all.

-

Streamlined Financial Router

This tool allows you to view ALL of your bank accounts, credit cards, loans, investment accounts etc. and make payments or move money with the draw of a line and click of a button. You've never experienced your finances like this before.

-

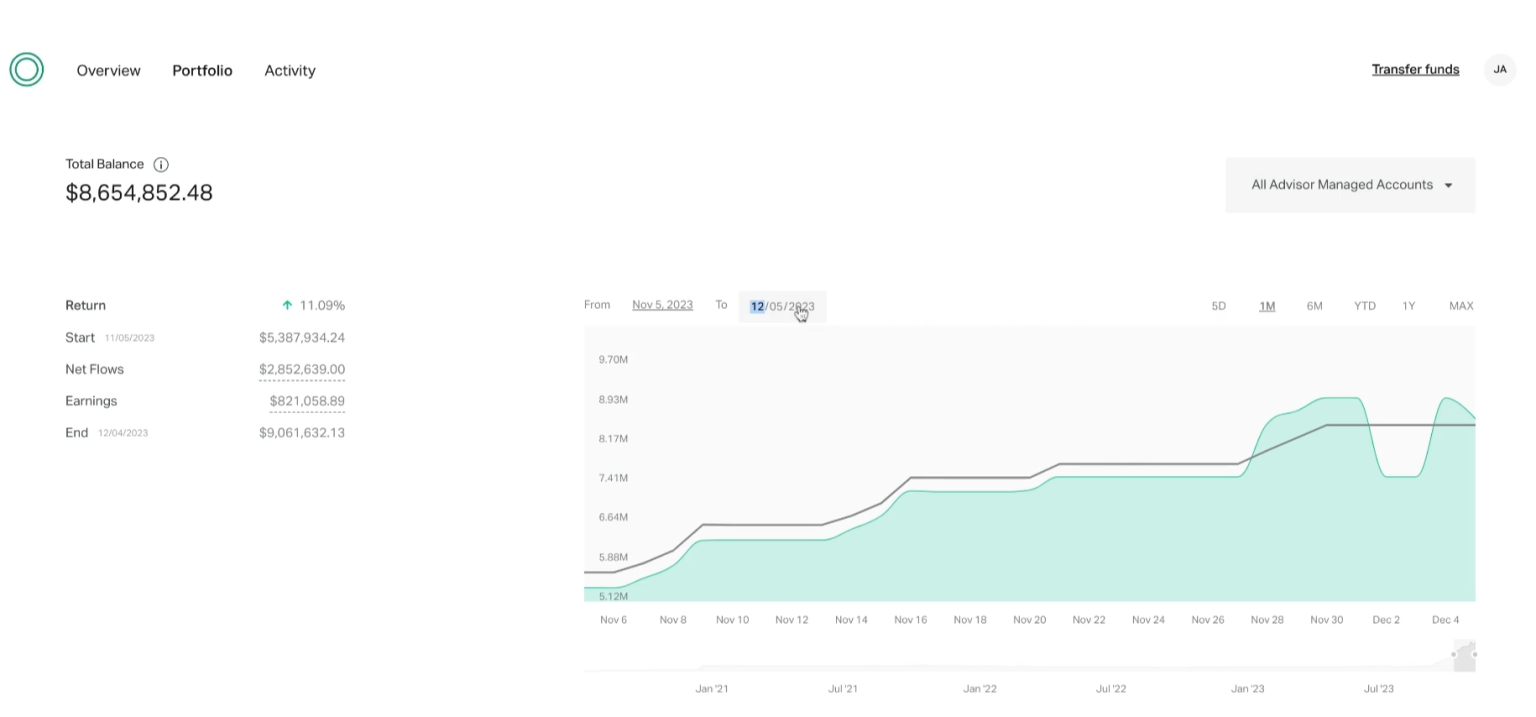

Net Worth Scorecard

This Scorecard truly takes the pulse of your financial health. It tells you how on track you are for goals and how much further you have to go to achieve them. This is a cornerstone of our process.

-

Online Community Access

Our online community is filled with like-minded individuals who are on a mission to better their personal finances.

-

Monitored Household Investment Accounts

We establish and monitor your personally owned investment account(s). These aren't 'grouped' workplace accounts or forgotten brokerage accounts. We track your portfolio regularly to make sure you are on a path consistent with your risk tolerance and goals.

-

Vital Document Maintenance

This new service is end to end encrypted through one of the most secure servers on the market. No more searching for your Homeowners insurance declarations page to compare this year's premiums to last. No more uncertainty around where your child's shot records are. We store all that you are comfortable with storing in the safest, client-first way possible.

-

Insurance Reviews

Typically, these documents read like Greek. The only ones who seem to understand them are the insurance agents who are paid by you having the coverages. Can you trust them if you question something? We will help you understand what you have and shop for other coverage if your current no longer serves you.

This is when saying "I know a guy" actually means something. We help with EVERYTHING money. A to z.

Frequently asked questions

You absolutely could!

But, there are things in life for which you would recruit the help of a trained professional. You could do the electrical, plumbing, car maintenance etc. yourself and save plenty of money. It just comes down to what is your time and mental bandwidth worth?

You are completely free and welcome to cancel your service if you so choose. Our retained services bill in arrears, meaning we do not collect a payment until the end of the current term. If you cancel in the middle of a period, you will only owe a prorated amount at the end of the term. We will transfer your accounts anywhere you need.

Yes, I am a fiduciary. This is a fancy word for saying I hold a legal, not just moral, obligation to act in your best interest. Registered Investment Advisors (RIAs) and Certified Financial Planners (CFPs) are Fiduciaries. Likewise, those who hold Series 65 or Series 7 & 66 are fiduciaries. There is something called a Suitability standard which other professionals in the financial space operate by. Make sure that if you work with someone, they are a fiduciary- for your own good.

We are big on the ‘less is more’ approach. We work with you to find a select group of quality names to hold for a target of 1 year minimum, unless things materially change with your portfolio or the company. Our goal is not to ‘beat the market’. A 20 yr average from 1998-2017, according to Dalbar & JP Morgan, the S&P returned an average of 7.2% while the average investor returned 2.6%. Make the investments, dont worry about the index, you’ll never be satisfied. The market is not our benchmark- hitting your target number by X date is.

© 2025 All Rights Reserved Paraclete Life Planning LLC

is proudly powered by WordPress